How do you know when your investment returns are good enough? What should be your benchmark for comparison? Your neighbor? Perhaps the brother-in-law who says he made a whopping 30% in one week buying stock in this new technology company that’s putting their heart rate monitor in every piece of active sportswear? 😊 When most investors hear a story like this, the “hurry-up” thoughts pour into their mind shouting….”Don’t Miss Out!” And the struggle begins.

A couple of weeks ago, I wrote about there being “One Number” in real estate investing that is the most important number for determining the value of an apartment building or other income property assets. That number is Net Operating Income (NOI). Today, I am providing you with Another Number that will assist you in managing your personal investment portfolio, as well as help you experience more freedom, resulting in more rest and better overall health. It is the only number that matters when tracking your personal financial goals. That One Number is your “Family Index.” It only makes sense to have a benchmark that is driven by your family’s dreams, instead of a passive benchmark that is functionally irrelevant to your goals of living well today and leaving a financial legacy that will contribute to your reputation tomorrow.

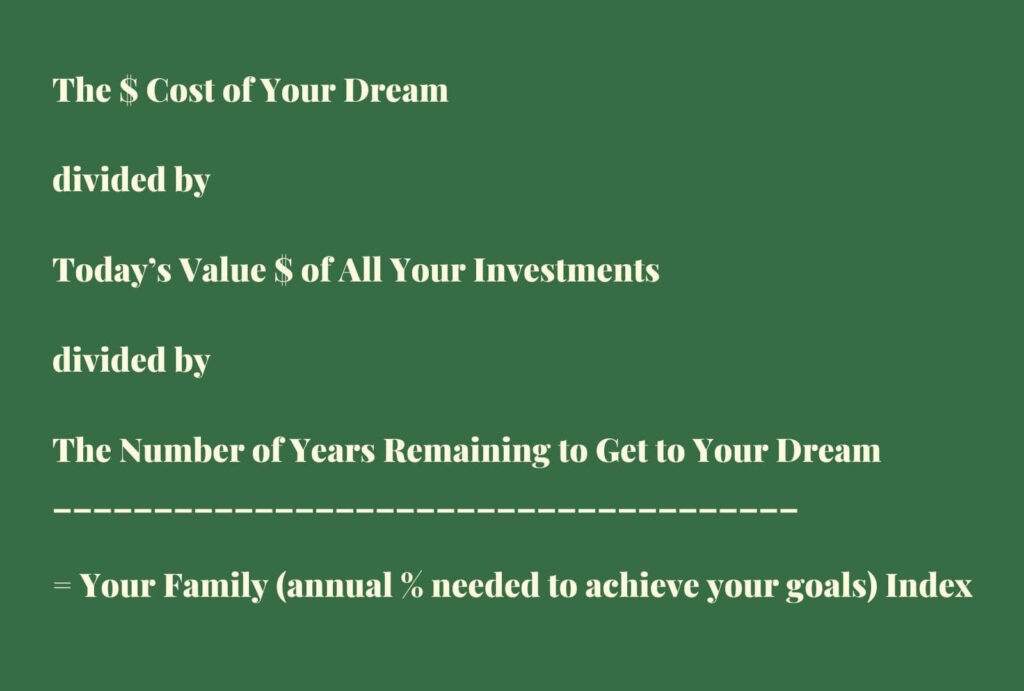

It is a simple formula that requires just three inputs. It looks like this:

Your Family Index is that percentage return on your current investment portfolio (ROI) including savings, that assures you will reach the financial goals you have today in the time-frame that you decide is right for you. After calculating dozens of Family Indexes for investors, the percentage is most often mid-single digits in size. I have found that having your own “Family Index” is like playing golf against the golf course instead of another golfer. Playing against the golfer makes it possible to win the bet without improving your game. But if you improve your score against the golf course, you are nearly certain to improve your game, and also win more bets.

Replace a focus on the S&P 500, the Dow Jones Industrial Avg, NASDAQ or a myriad of bond indexes and focus on designing your investment portfolio to hit your Family Index. And as long as you are matching or exceeding that number, you win.

The Cost of Your Dream

But wait! Calculating the “cost of my dream” assumes that I have discovered my dream. This is not an easy task. How does a person define, much more quantify their dreams? The answer is in the questions. For example, years ago a friend of mine from Des Moines, IA, Jerry Foster, presented me with three questions that changed my life. I believe that if you take the time to write down your answers to the questions as you read them, it will change your life too. Get some paper. Do it!

The first question goes like this: “Wealthy is the person who…?”. Fill in the blank. Write down the answer to that question with the first thoughts being trusted as your truth.

The second question is just as profound: “What difference do you want to make in life before you die?” Now, this answer pulls out your passion, your purpose, and even offers a hint of the vision that is in you, and likely has been in you most of your adult life. Write down your answer now.

The third question is: “How long do you want this difference to last?” Write your answer.

If you haven’t already done so, take the time, now, to answer those questions.

Now, let me tell you what you answered. The first answer gives you clear insights into your “governing values”. It reveals what motivates you, what you will defend if threatened, and what frames your way of thinking.

Your second answer reveals your “dream”; what you were made to do or become. This insight is a gift. Be sure to open it in a serious moment, so as not to trivialize what is embedded in your response, which is One Thing you could live for.

The third answer reveals the timeline for which you are investing your time and treasure. This becomes the end-game objective. It’s the clock that tells you when that dream is done. The achievements along the way are the milestones that get you there.

Know that this exercise is not complicated, but it is quite effective for those who have never been compelled to live life toward their dream. As Zig Ziglar has been quoted to say, “The great majority of people are ‘wandering generalities’ rather than ‘meaningful specifics’. The fact is that you can’t hit a target that you can’t see. So If you don’t know where you are going, you will probably end up somewhere else.”

Once you’ve calculated your Family Index, share it with your Financial Advisor. Tell them your dream, your governing value(s), and the timeline you wish to have your dream remain relevant. I assure you that your Advisor will be pleased with your assistance at making their job more meaningful and fun. In return, you will no longer be “playing” the market, or competing with your neighbor. You will only be focused on your Family Index being met with the least amount of portfolio risk to get there. Nothing else should matter.

Now, one last comment. If you don’t write down your answers, that is a reveal in itself. It happens all the time. There are people who know that they should, they know that they could, but they don’t! I don’t know why they don’t, they just don’t! Lean in! Apply meaning to your investments. We are the only beings on the planet who can create their own future. Don’t waste the privilege. Someone down your family tree is counting on you.

Disclaimer: Please consult with your tax accountant and financial advisor to properly interpret and apply your family index on a pretax and after-tax basis.