VisionWise Capital is your trusted partner for real estate investing.

About VISIONWISE Capital

VisionWise Capital creates quality commercial real estate investments with the security and performance your portfolio deserves.

Even savvy investors may harbor concerns about adding real estate to their portfolio. VWC removes risks with fee efficient and expertly managed properties for accredited investors who know the importance of diversifying their holdings.

Diversify Your Portfolio

Go beyond stocks, bonds and ETF’s. Commercial real estate can play a key role in optimizing the performance of your investments as well as build wealth over time.

Protect Your Principal

The greatest risk in real estate investing is the structure of the debt. VWC keeps the loan to value on all properties under 50% to minimize and reduce investment risk.

Invest with Experts

Our founder Sanford Coggins brings a strong commitment to the stewardship of each investor’s capital. VWC invests “skin in the game” on every project.

Why VisionWise Capital?

Many investors miss opportunities because they believe investing in real estate is too complicated and risky. Let VisionWise Capital change that.

As a Registered Investment Advisor (RIA), Sanford Coggins often searched for commercial real estate investments for high-net-worth clients wishing to diversify their portfolios. Time after time, he only found subpar investments.

Most options available were public and private Real Estate Investment Trusts (REITs) with complicated ownership/fee structures and high costs. Sanford knew REITs weren’t the answer for his clients.

He sought a real estate investment he could personally “go visit and kick.”

Since the market didn’t have the investments Sanford knew his clients deserved, he set out to do it himself. Selling his RIA practice, he applied decades of experience in commercial real estate/wealth management to create something new: a plan for accredited investors to add California multifamily real estate to their portfolios without the costs and complications of a REIT.

Sanford Coggins created the VisionWise Capital Multifamily Fund to help RIAs and high-net-worth private investors confidently diversify their portfolios with real estate investments both safe and profitable.

Located in Orange County, California, our team is 100% dedicated to our mission of being thoughtful stewards of our investors’ capital.

Our Process for Your Success

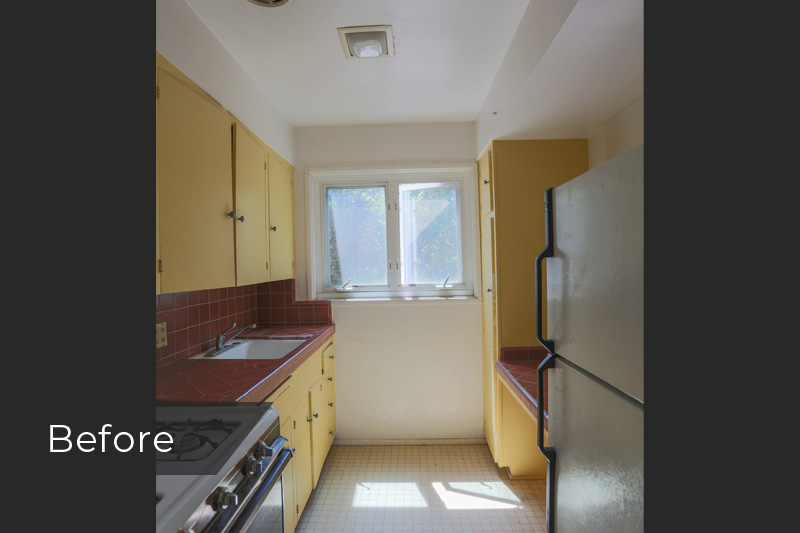

BUY

VWC buys “old and tired” multifamily properties, ranging from 5 – 50 units located in Southern California. We finance each property with a conservative loan to value ratio.

Restore

VWC completes quality renovations that appeal to today’s consumer. Refurbished units are leased at prevailing market rates.

MANAGE

VWC utilizes cost effective measures to increase a property’s cash flow and its appreciation.

REINVEST

VWC’s proven success results in additional investment opportunities as we continue to identify properties that fit our market niche.

VisionWise Capital brings you:

Portfolio Diversity

Our sound commercial real estate investments reduce your risk, offering untapped opportunities for greater prosperity.

Safety of Principal

The amount of debt in capital structure is your biggest threat when investing in commercial real estate. That’s why we limit the loan to value ratio of all properties to 50% or less. Down cycles needn’t damage your portfolio!

Low Costs

Investment performance is meaningless if your gains are chewed up by high fees. We promise low expenses as compared to REITs to maximize your returns.

Tax Advantages

As a Class Member, you’ll receive a Schedule K1 reflecting your proportionate share of partnership income, losses, deductions, depreciations, and credits.

Retirement Accounts

Certain tax advantaged accounts can partake in investments via a custodian.

VWC Press

Why Southern California Multifamily Investing Outperforms Traditional Portfolios

In an era where inflation threatens returns and market volatility undermines confidence, Southern California multifamily investing offers an attractive alternative for family offices seeking stable growth with principled stewardship. At VisionWise Capital, we’ve built...

Alternative Investment Timing: A Generational Opportunity for Family Offices

Why I’m Optimistic About the Current Market Cycle If you’ve followed market cycles over time, you know this truth: every downturn creates its own rebound. At VisionWise Capital, I believe we’re entering a new phase, one that offers a rare opportunity for alternative...

Active Fund –

VWC Multifamily Fund V

Property Type: Exclusively Multifamily

Location: Southern California

Offering: $50,000,000

Preferred Return – Seven percent (7%) per annum, Paid Quarterly

Projected Hold: 4 Years

Min. Investment: $100,000